Rs 5 lakh for first-time entrepreneurs, including women, SC and ST,

Scheme for First time #Entrepreneurs: Rs 5 lakhfor first-time entrepreneurs, including women, Schedule castes and Schedule Tribes, a new scheme, to be launched, to provide term loans up to ₹ 2 crore during the next 5 years This new scheme for first-time #entrepreneurs is a significant step toward fostering #entrepreneurship, #job creation, and #economic inclusivity. […]

Customised Credit Cards for Micro Enterprises with ₹ 5 lakh limit

Credit Cards for Micro Enterprises ;Customised Credit Cards with a ₹ 5 lakh limit for micro enterprises registered on Udyam portal. In the first year, 10 lakh such cards will be issued. This initiative is a significant step towards addressing the financial challenges faced by micro enterprises. By providing easy access to credit with a […]

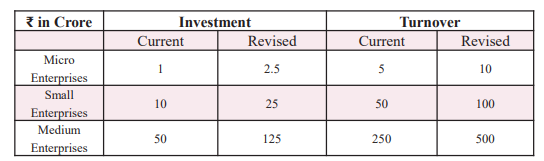

Revised Criterion of MSME will boost investment in technology

In recent budget speech, classification of MSME industries is revised considering increase economic activities that allow industries to access finance, invest in machinery and advanced their technology. . Got is focusing on MSME Sector as Second engine of Growth after agriculture. Classification of MSME has been changed time to time in India. Reclassification will increase […]

Revised Criterion of MSME in Budget 2025-26

Rise of the Startup Culture

• The Indian startup ecosystem is growing rapidly, with many MSMEs emerging in sectors like edtech, healthtech, agritech, and green energy. • Venture capital and angel investments are becoming more accessible.

Digital Transformation

• MSMEs are increasingly adopting digital payments, cloud computing, AI, and e-commerce to enhance efficiency. • Government initiatives like Digital India and platforms like ONDC (Open Network for Digital Commerce) are helping MSMEs go online and expand their market reach

Government Support & Policies

• The Indian government has launched multiple initiatives such as Atmanirbhar Bharat, Make in India, Startup India, and MSME Samadhan to boost MSME growth. • The Udyam Registration process simplifies MSME registration, enabling better access to loans, subsidies, and incentives. • Production-Linked Incentive (PLI) schemes in key sectors (like electronics, pharmaceuticals, textiles) offer a major […]

Government Initiatives for MSMEs

• Udyam Registration: A simplified process for MSME registration. • Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): Offers collateral-free loans. • Pradhan Mantri MUDRA Yojana (PMMY): Provides microfinance up to ₹10 lakh. • Emergency Credit Line Guarantee Scheme (ECLGS): Helps MSMEs recover from COVID-19 losses. • Make in India & Atmanirbhar Bharat: […]

Importance of MSME Sector in India

• Employment Generation: Provides jobs to over 110 million people. • GDP Contribution: Contributes around 30% of India’s GDP. • Export Contribution: Accounts for nearly 45% of India’s total exports. • Industrial Output: Contributes about 40% to the total manufacturing output.

Key Challenges Faced by MSME

• Limited Access to Finance: Many MSMEs struggle to get loans due to lack of collateral. • Technological Gaps: Traditional manufacturing units lack modern technology. • Regulatory Compliance: Complicated taxation, labor laws, and documentation processes. • Market Competition: Competing with large corporations and cheap imports from China. • Delayed Payments: Large firms and government entities […]